OUTLIER – our Golden Candlestick Pattern

February 3, 2020

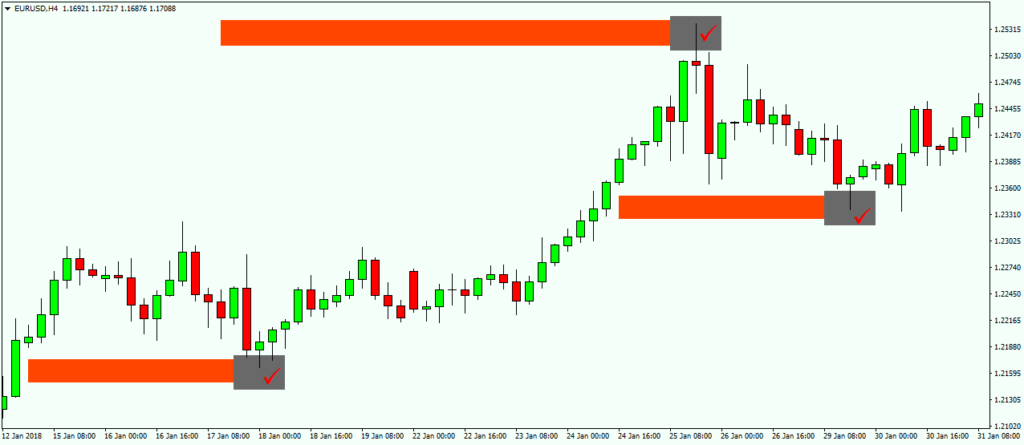

As its name implies, Outliers are candlesticks who pushed away from the crowd.

It has to be with a short body, preferable bearish for bearish opportunities and bullish for bullish opportunities.

The wick has to be big and somehow aggressive. And the body has to be small. Just like a hammer/shooting star/ handing man and Doji…

The candlestick’s wick has to be away from the crowd, which means it reaches areas price didn’t reach for quite some time.

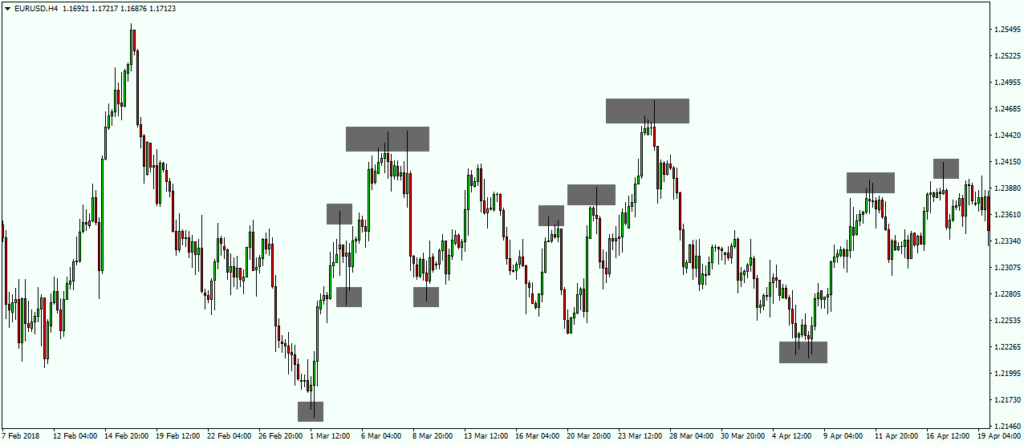

Here is another example showing more Outlier Candlestick Patterns.

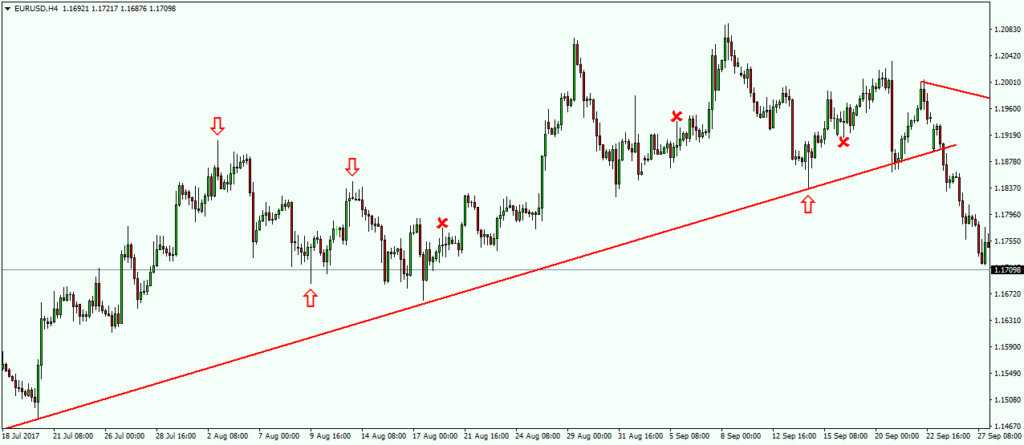

The examples with the Arrows are valid Outliers patterns, but the ones with the X are not as they did not push away from the crowd and in fact, stuck in a choppy range.

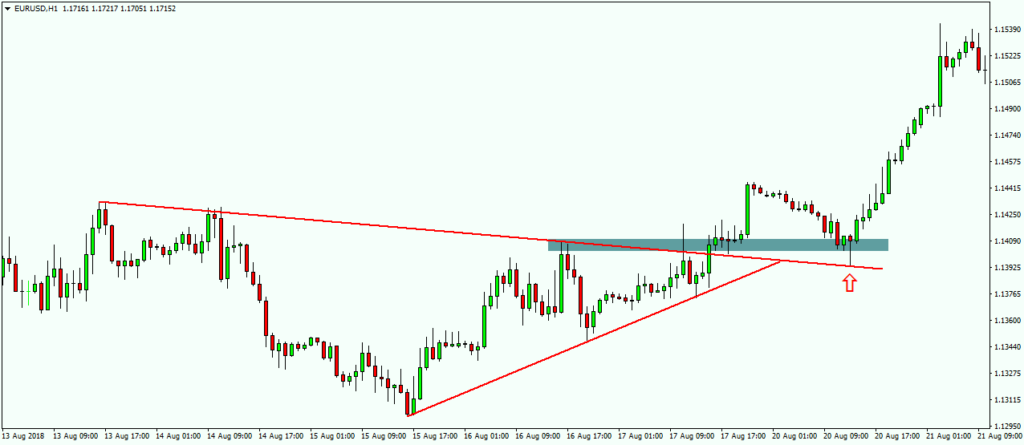

Reminder: Candlesticks patterns are not stand-alone systems, but acts as one more confluence or trigger for an existing setup.

Just like in these two examples (above and below), our Outlier Pattern served as a trigger for our rejection/retest setups.

That’s it for our Outlier Candlestick Pattern. Feel free to share your thoughts by leaving a comment.

All Strategies are Good; if Managed Properly!

~Rich

www.theSignalyst.com

www.RichTL.com