The Psychology Behind Round Numbers

February 3, 2020

Have you ever wondered why prices tend to stall at certain levels in the forex market? Is this just a coincidence or is there a valid reason behind this happening?

Well, this phenomenon may actually be explained based on the psychology of forex traders.

As humans, we tend to think in terms of whole, round numbers rather than in terms of uneven random numbers. This happens very regularly in everyday life where numbers tend to be rounded up or down in order to simplify things.

For example, if someone asked you the time and you looked at your watch and it was 12:29 pm.

What time would you give the person? Based on the psychology of rounding, many persons are likely to just say 12:30 pm rather than 12:29 pm since 12:30 pm is a rounded number and 12:29 is not.

Round Numbers in Trading

By default, most traders have a tendency to prefer rounded currency values to odd, random values.

Because of this psychology, areas of support and resistance tend to form around certain price levels since traders subconsciously tend to place stops and take profits at areas where the price is rounded.

For example, a trader is more likely to place a stop at the 1.2500 level than at the 1.2502 level

– Double Zeros, Increments of 500 and 100

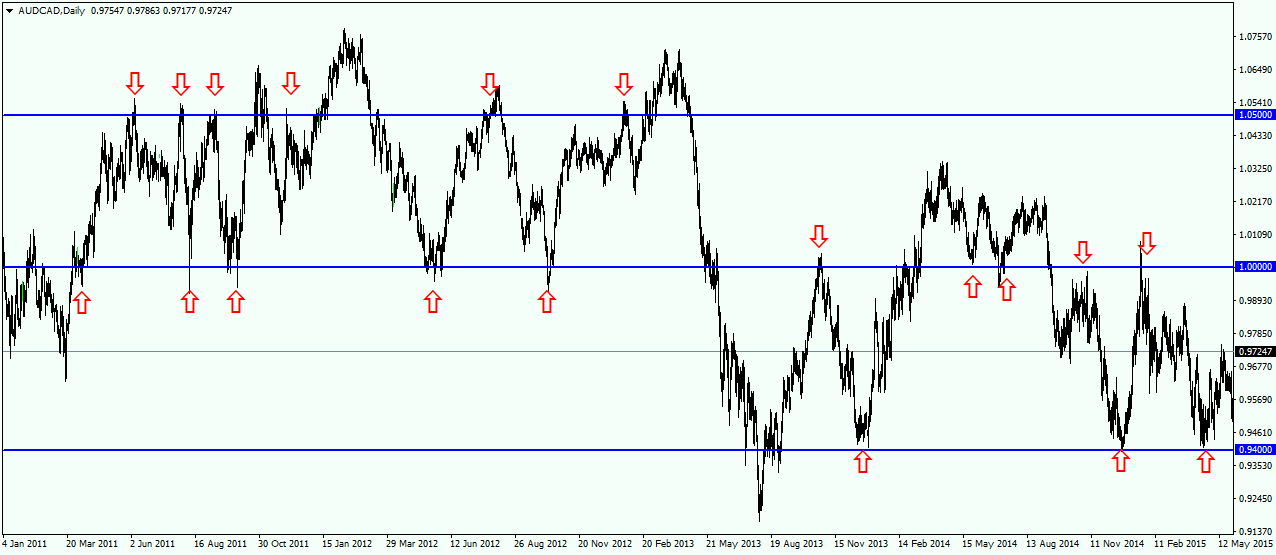

In forex trading, rounded prices usually are regarded as those prices in which there are double zeroes (or more) at the end of the price eg. 1.3400 or 1.5000.

Usually the more zeroes at the end of the price, the stronger psychological level and barrier.

In addition, short-term intraday traders also view half way points and price points that are multiples of 100 to be rounded.

If you were to study any price chart, you would find that areas of resistance and support usually form at these price levels.

Price swings tend to take place at these resistance and support levels.

Once the price crosses these invisible barriers, the price changes from being a level of support to being a level of resistance or from being a level of resistance to a level of support.

Traders often use these signals as an indication of what is likely to happen once price approaches these psychological levels.

If price tended to stall at these levels when prices were going up, then chances are great that they will stall at that same price, should the price reverse and fall.

The chart above shows an area of important support turned into an area of resistance once the price breaks below the support level.

Feel free to share your thoughts by leaving a comment.

All Strategies are Good; if Managed Properly!

~Rich

www.theSignalyst.com

www.RichTL.com